Why do all the hot SaaS companies like Salesforce, Workday, Box, Hubspot, Zendesk and others not profitable? Have profits gone out of style? Is operating an unprofitable business a viable long-term business model or a current market anomaly? Let’s dig into the counter-intuitiveness of SaaS financial metrics…

First, what profits?

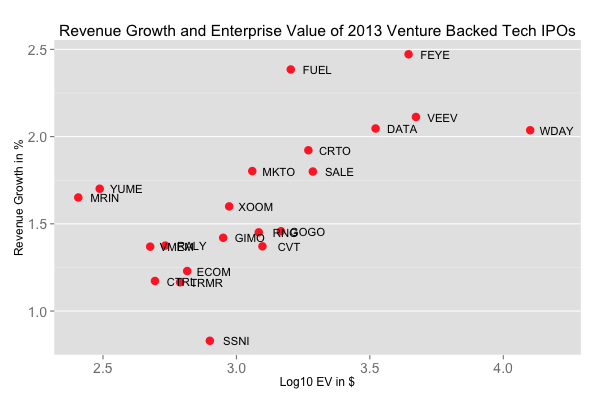

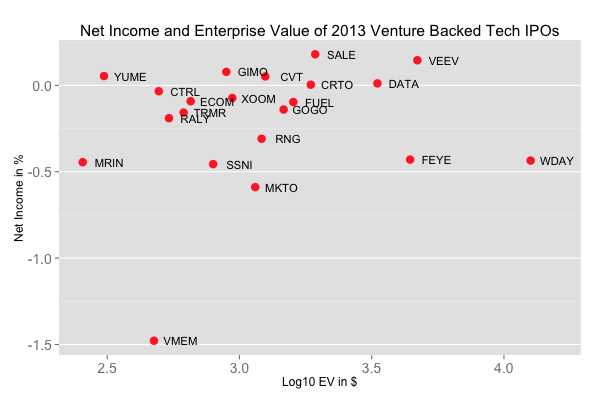

A subscription model with recurring revenue is a different beast. To understand why this is the case, I’ve included growth rates and profitability ratios for a cohort of SaaS companies (source: Tom Tunguz)

|

|

There’s a stunning correlation between revenue growth and market valuations as seen on the graph on the left. In contrast, profits and valuations don’t seem to have much of a correlation. For the last couple of years, the market seems to prefer growth rates over profits.

SaaS Profits are back-loaded

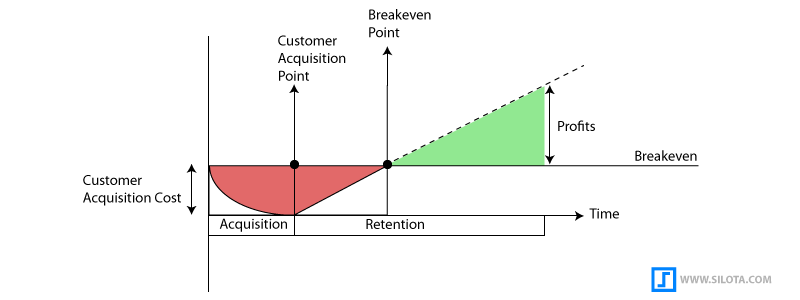

To put this in context of a SaaS company going about doing its business:

- spend money on marketing and sales upfront to get new customers

- make revenues in small increments through recurring revenues as long as they stay a customer

- recoup the costs of acquisition at a future point in time

- profits are realized at this point and not when they begin being a customer

100% of your profits come from existing customers and the quicker you can reach breakeven point, the faster you can start making profits.

The One True Metric: Customer LifeTime Value

Although you don’t start making profits right away, the upside of the recurring revenue model is that as long you maintain the relationship with the customer, the greater the profits. Therefore, the one true measure of a successful company is the customer lifetime and the value generated from that period.

Why so? Picking Customer Lifetime Value has many advantages in thinking about your business:

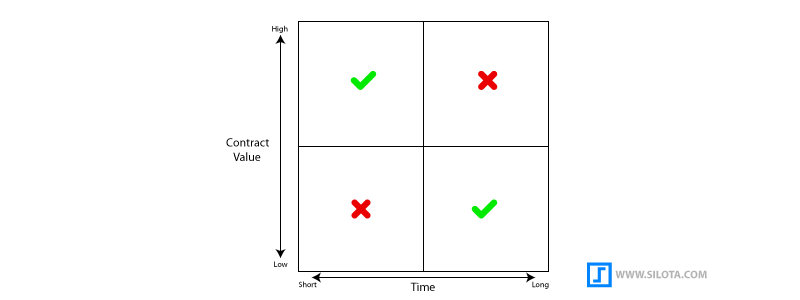

- The lifetime value provides optics into your business: do you have a lot of high value, short lifetime customers or vice-versa. Or one of the other quadrants, and God help you. :)

- It can help shape your marketing and customer acquisition costs. How much can you afford to spend on marketing? Can you afford to have an inside sales team? Do you rely mostly on automation and self-serve?

- It can help shape you retention strategies. How much can you spend on improving renewal rates? Can you invest in a Customer Success team or is it mostly just transactional support? How often can you get on a plane to see your customers?

- It is forward looking. Unlike:

- revenue, a lagging indicator

- bookings, no insight into the existing customer base

- churn, no insight into new sales

- acquisition cost, no insight into the recurring economics of the business

- ARR, incomplete as you might have high sales and high churn or vice-versa

Calculating Customer Lifetime Value

A nuanced topic, fortunately, plenty has been already written:

- Shopify on defining churn

- KISSmetrics on calculating lifetime value

- Joel York has a series of posts on SaaS metrics, including churn

- David Skok provides detailed definitions of SaaS metrics

Three levers of profitability

With these economics in mind, you have four levers to make more profits:

1. Reduce Churn

A lot has been written on this topic — including my previous post on why customers churn. To summarize that post: poor onboarding, low product usage and sponsor relationships make up the major reasons for a customer to churn. If a customer churns before reaching breakeven, your company has just lost money.

2. Decrease time to breakeven

You can determine how far out the breakeven point is in the future based on the initial contract value. You can try to bring that closer by having upsells and cross-sells. The most successful companies have a friction-free way to add new people, consume more product in a self-serve way. This allows increases the recurring revenue without affecting the cost of customer acquisition.

3. Renewals

You can focus on improving renewal rates so that existing customers continue to stay longer as customers. The most successful companies:

- continually invest in product improvements

- retention marketing: helping existing customer become power users of your product

- building a community around the problem you’re trying to solve

4. Decrease cost of acquisition

You can try decreasing the cost of customer acquisition in creative ways — asking for referrals, encouraging word of mouth, building in viral loops, investing in pre-sales collateral and introducing efficiency in onboarding processes.

Takeaways

There’s so much to learn / share on SaaS metrics — hopefully I’ve convinced you that profits come from existing customers and not new customers. A lot of SaaS business leaders focus on the frontend (customer acquisition) and not nearly enough on keeping them around longer.

I’m always interested in hearing your thoughts about SaaS and the industry. Fee free to reach out via the comments below or one of the other ways.