If you’re a SaaS business owner, you’re very familiar with the “5 C’s” of SaaS metrics – Cash, Churn, Committed Monthly Recurring Revenue, Customer Acquisition Cost, and Customer Lifetime Value. Conventional wisdom dictates that CLTV is the north star metric for a healthy SaaS business, but is that really true for bootstrapped businesses? In this post I argue otherwise and present a case for other metrics that might be a better fit.

There’s plenty of great material out there on SaaS metrics. Everything that Jason Lemkin and David Skok write is pretty great, with the caveat that it’s written from the context of a venture capital funded business.

So how can bootstrapped businesses manage their financial metrics?

Let’s look at three cases of conventional wisdom that we challenge and propose an alternative that are much more effective for the financial health of a bootstrapped business.

1. Lifetime Value -vs- Acquisition Cost Ratio is a Red Herring

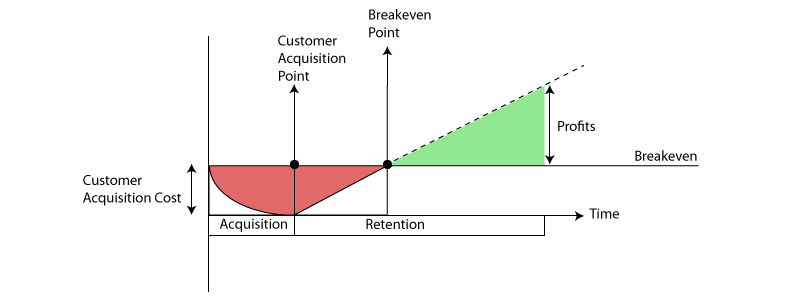

Status Quo: The LTV/CAC ratio is the holy grail of SaaS. The often touted benchmark is that this ratio needs to be three or more for your business to make sense.

Our take: When the lifetime of a customer is a few years, it can take literally years before you start to realize this ratio. If you’re mostly selling to other small and medium sized businesses, a lot of factors can be out of your control. For instance, a customer can outgrow your solution, decide that it no longer has a need for your product, depressed economic conditions that might rise cancellation rates, etc.

It’s a lot better to focus on your payback period, i.e., how long it takes to recoup the acquisition costs.

2. The focus on only MRR is a slippery slope

Status Quo: Indiscriminate growth at all costs. Seeing the MRR grow every month is required to keep your investors happy and might also be necessary for follow up funding.

Our take: While MRR is a nice number to watch grow, it’s detached from the reality of your bank account. Annual prepayments, delays in procurement, unexpected expenses like legal fees & PR all affect the cash in the bank.

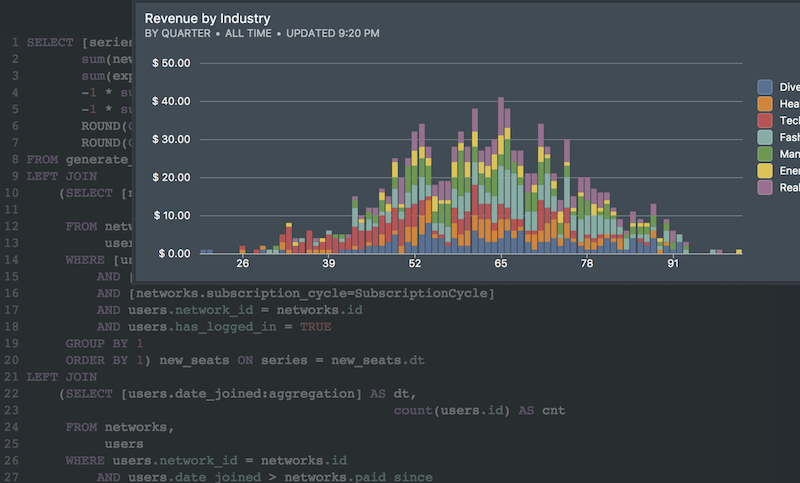

We’ve included the MRR chart for a healthy, growing and more importantly bootstrapped business called Hubstaff. Steady, consistent growth month over month and fairly predictable.

Cash on the other hand is more episodic because of the afore mentioned reasons. Quite unpredictable.

Having enough cash in the bank is the responsibility of the CEO – and make sure you don’t spend cash you don’t actually have. Being conservative with cash is a little more work:

- Hire a great accountant that has experience with SaaS financials very early on.

- Start asking your customers to pay annually for your product. Offer a discount or professional services to make it worth their while.

- Put a break on hiring and solve the problems you have with your current team. There’s a great example by ConvertKit who recently went through this.

- Outsource some work that can be done for cheaper while are you understaffed by trying to maintain your cashflow.

3. Expansion Revenue is not Free Money

Status Quo: Expansion Revenue is the beauty of SaaS. Your current customers are lining up at your doors to buy more of your product. Expansion Revenue is some of the most profitable revenue you can add and is essentially free money.

Our take: While expansion revenue might seem like “free money” it comes with an expectation of a higher service level.

A bootstrapped SaaS company needs to think of expansion in conjunction with talent to maintain that expansion over time. There are 2 areas to invest in: customer success and customer support.

- Customer Success: if your expansion revenue is growing, you may want to dig further to see if the segments seeing the fastest growth have the appropriate allocation for customer success. We’ve written before about the challenges of misallocating resources. If your customers feels mismanaged, they will churn out of frustration.

- Customer Support: more expansion means more support tickets. Most support interactions are transactional, but if your expansion is coming from a large enterprise customer that is in the process of deploying your solution, you will want to add an additional level of coordination to manage that growth.

Conclusions

Cash in the bank, pay back periods and talent to support your expansion revenue are all more important right now than your LTV. For all the functional work in between – LTV is a distraction from running a financially stable and responsible SaaS business.

Photo Credit: Unsplash